Keller Group plc (“Keller” or “the Group”) is today presenting its financial statements prepared in accordance with IFRS for the year ended 31 December 2004 and the six months ended 30 June 2004.

The decrease in the adjusted earnings per share is entirely due to a deferred tax charge arising under IFRS as a result of not amortising goodwill which is deductible for tax purposes. Were the Group not obtaining this tax cash benefit, the 2004 adjusted earnings per share under IFRS would be marginally higher than as reported under UK GAAP. This deferred tax charge is an accounting adjustment only and will not change the cash tax paid by the Group.

The transition to IFRS will leave:

- Cash flows unaffected

- Dividend policy and ability to pay dividends unchanged

- Banking arrangements unaffected

- Keller’s underlying financial and operating performance unaffected

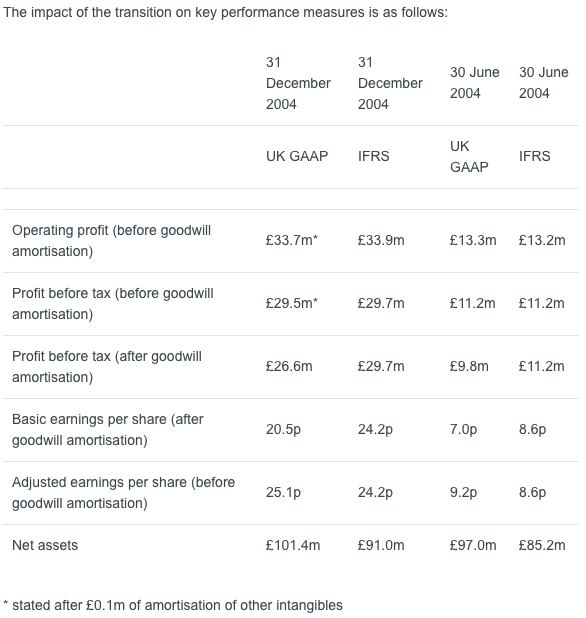

The changes in accounting policies which have the most significant effects on the restated numbers for the year ended 31 December 2004 are:

- The cessation of goodwill amortisation and the related deferred tax charge

- The retranslation of goodwill at closing exchange rates

- The recognition of pension scheme deficits and the related deferred tax assets on the balance sheet

- The recognition of dividends only once declared or paid

Keller will be publishing a half year trading update in advance of its Annual General Meeting on 23 June 2005, and intends to announce its 2005 interim results, reported under IFRS, on 22 August 2005.